Adoption rates are accelerating, customer demand is growing and the payment industry is continuing to innovate so it’s never been more important to go cashless “the right way”.

Choose the right cashless solution and you can drive revenue, boost customer loyalty and reduce operational costs. But not all cashless payment systems are equal.

Today, there are so many different ways to take your business cashless. Each option has its own benefits and drawbacks. Perceived complexity and lack of industry knowledge can deter businesses from exploring all the options out there.

Yet implementing cashless payments technology at your event or venue can offer significant opportunities for your business. Reduce lines, drive additional revenue, boost operational efficiencies, understand every single one of your guests and drive loyalty and engagement.

Sounds good? Then read on.

This guide will help you choose the right solution for your business. You’ll get under the hood of touchless payments. We’ll help you understand the jargon and the solutions available. And we’ll show you how to choose the right touchless solution for your business by analysing your business objectives.

Using this guide, you’ll get the complete overview. We’ll cover:

- The meaning of cashless payments

- The difference between cashless and contactless payments

- Payment industry jargon - demystified

- The benefits of implementing cashless solutions

- Common objections to going cashless

- The different types of cashless systems

- How to choose the ideal cashless payment solution for your business

- The Cashless Payments Guide

- Leading trends in the payments industry

1. What are cashless payments?

Before you implement cashless payments at your event or venue, you need to understand what they are and how they can benefit your business. In the strictest sense, a cashless payment can be defined as any type of payment that is made without using cash.

So for example, debit cards, bank transfers and digital wallets are all examples of cashless payments as no physical cash is transferred to make the transaction.

A system for cashless payments is simply the technology that facilitates cashless transactions. This includes the hardware, software and any other part of the technology infrastructure.

2. The difference between cashless systems and contactless systems

In our industry, we can cite a number of key differences between cashless systems and contactless systems however. Let's look at those differences in some detail.

A) Closed loop vs open loop

One key difference between cashless and contactless is that Tappit’s cashless payment system operates on a closed loop system - an independent payment mechanism that doesn’t use third party intermediaries (e.g. the banks) to process the payment.

The Starbucks app is a well known example of a closed-loop cashless payment system. Until recently, the app had the most mobile payment users in the US. It’s now second, only to Apple Pay. Now that’s some feat when you consider Apple Pay is a widely accepted payment method, and the Starbucks app is only accepted at their locations.

A store gift card is a further example of a closed loop payment system. A gift card allows the redeemer to spend up to a certain amount with the designated merchant and the transaction cost is deducted from the card balance. Unlike a debit card, the gift card can only be used to pay for items at specified locations - in this case, at a nominated retailer.

RFID wristbands are yet another example of a closed loop payment system. They can only be used to pay for items a particular festival or event. In the same way, a white-label mobile wallet embedded in your favourite team’s app can only be used to buy food and merchandise at the sport stadium.

Here’s how a closed loop payment system like Tappit works in practice. Customers upload money into a spending account which is linked to a payment device - such as an RFID wristband or white-label mobile wallet. To make any purchases, the customer points the wristband or mobile wallet at a device and the payment is taken.

Contactless payments meanwhile operate on an open loop system. A Visa debit card issued by your bank is a good example of such a system. The debit card is linked to your bank account and can be used to pay for goods and services anywhere that accepts that payment method - so pretty much anywhere that accepts contactless.

To a customer, the process is very similar to the experience of using contactless cards. It’s what’s happening behind the scenes that sets cashless apart from contactless technology.

B) Next level customer transaction data

There is another key difference between cashless payment systems and contactless ones - and it’s often the deciding factor when businesses choose a cashless solution over a contactless one.

With contactless payments, customer transaction data is only visible to the banks. Conversely, cashless payment systems enables businesses to collect all their customer transaction data. This can be analysed for deeper insights into the buying behaviour of individuals. These insights can be used to drive revenue, build loyalty and cut costs in all kinds of ways.

Here are some ideas. Once you understand the buyers' behaviour through data, you can offer timely, personalised offers and promotions which will drive loyalty. Securing new sponsorship deals can be made much easier as you can easily demonstrate ROI. Crowd control can be managed more effectively as bottlenecks can be quickly identified and staff can be deployed accordingly.

Further reading: Cashless vs Contactless

In this post, we discuss some of the key difference between cashless and contactless payments.

3. Payment industry jargon demystified

The payments industry is fast-paced, innovative and constantly evolving. As a result it can be challenging to keep up with all the terminology.

So we’ve put together a glossary of terms to help you cut through the jargon. Take a look at this reference to get up to speed.

Further reading: Cashless payments industry glossary of terms

In this post, we’ve selected the most commonly used terms and provided a definition.

4. The benefits of implementing cashless payments for your business

The festival industry was an early adopter of cashless payment solutions. Coachella went cashless for the first time in 2013, and Snowbombing festival followed suit in 2015. Today, it’s not just the huge festivals that are embracing this technology, there are an increasing number of verticals that are choosing to implement cashless payment systems - from sports stadiums, colleges and universities, to hotels and resorts, theme parks and casinos.

The first iteration of cashless payments used RFID technology and this technology remains the most popular choice for festivals, or any event where mobile service is an issue.

In the last few years, we’ve also experienced huge growth in cashless payment systems, powered by mobile wallets. Whilst mobile payment technology has been around for some time now, the advent of Covid resulted in increased adoption of mobile payments as people looked to touchless alternatives to chip and pin pads or ‘dirty cash’.

In previous years, organisations may have felt that their customers weren’t ‘ready’ to go cashless. This is no longer the case.

More and more organisations realise the benefits of implementing cashless payment solutions. In sports for example, between 2020 and 2021, twenty-nine out of the thirty NFL teams moved to cashless payments. And whilst Soldier Field, home of the Chicago Bears still accepts cash, they did launch a mobile app in September 2021, with incentives for customers to make the switch to cashless.

So why have we seen so many businesses go cashless in recent years?

Well, there’s something for everyone:

Business owners

Higher revenue, lower costs, new income streams, more transparency, more capacity due to faster transaction times, fraud and theft are eliminated. Real-time data insights which can be used to further drive revenue.

Sponsors & partners

Increased efficiency, lower head count, improved reporting, demonstrable ROI.

Operations

Improved event security with access and zone management, real-time analytics data and touchless payments which reduce the risk of covid transmission. Faster reconciliation, no costs or hassle associated with cash handling.

Customers

Less time waiting in line, better hygiene, more time to spend enjoying yourself, peace of mind as the risk of petty theft is reduced, targeted promotions and rewards.

Marketing teams

Access to first party data to leverage in targeted marketing campaigns and loyalty programmes. Targeting is improved, response rates are higher.

Business intelligence

Access to all customer transaction data, connect all data points in a single data ecosystem, build a 360 degree view of every person that enters your event or venue, not just the ticket buyer.

Let’s take a look at some of those key benefits in more detail and understand why so many organisations are making the move.

Whilst shorter lines and increased revenue are worthy benefits, the next-generation of cashless payment systems offer sophisticated data platforms and customer loyalty programme functionality. It’s these differentiators which offer businesses a significant advantage over contactless cards or third party mobile wallets.

Further reading: 6 reasons to choose cashless payment systems over contactless

5. Common objections to going cashless

Despite strong evidence to support the benefits of cashless payment systems, we do of course come across reservations or concerns.

These are to be expected, after all cashless payment systems require investment. There’s the fixed costs, getting buy-in across the business, staff training, time to implement and so on. These all need to be factored into the final decision. Businesses need to be confident that the technology will provide a return on investment.

We thought it would be helpful to get feedback from the wider team on the most common objections they come across when speaking to potential customers. From concerns customers aren’t ready to go cashless, to worries about data privacy and security - we’ve assessed them all and here’s our responses to those concerns.

Further reading: Common objections to going cashless

6. The different types of cashless payments

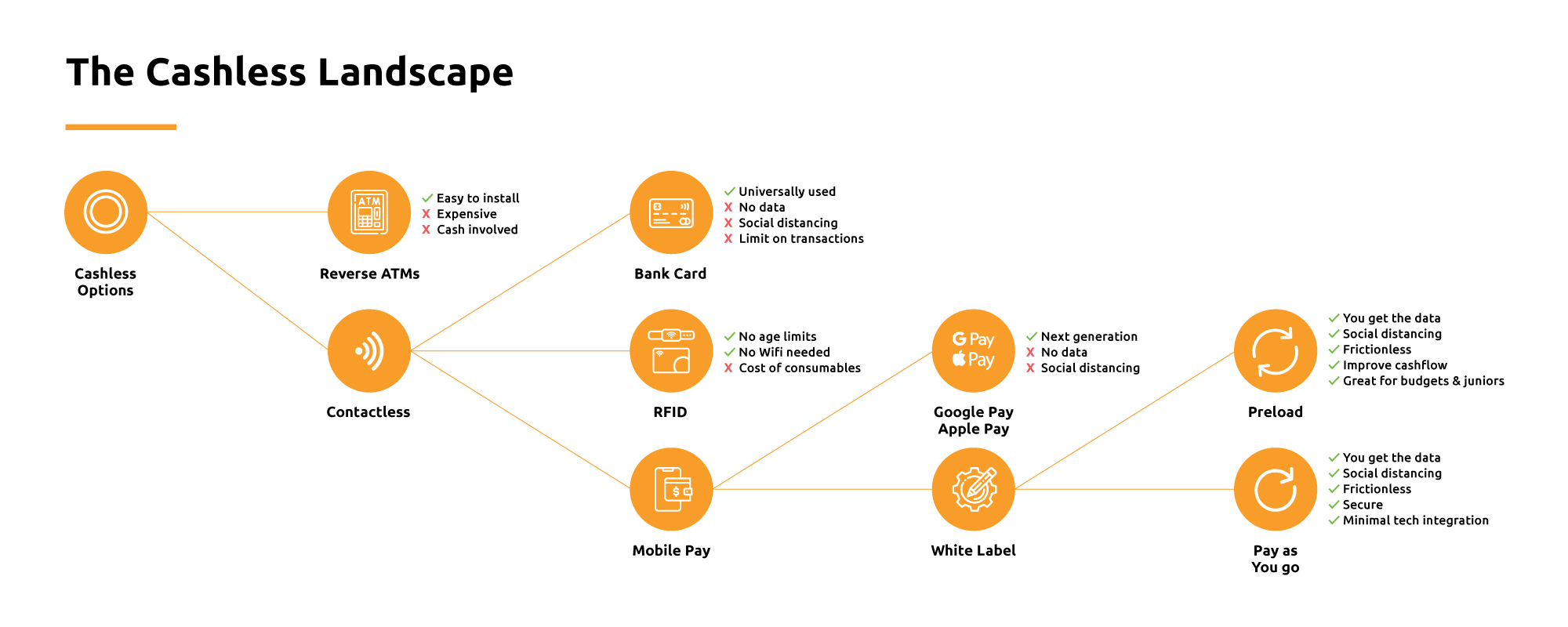

We’ve already discussed some of the different types of cashless payments available and delved a little deeper into the differences between cashless payments and contactless payments. So now, let’s compare the different types of cashless payment systems available.

We’ve broken down the different types of cashless systems, compared them side by side and have assessed the benefits and drawbacks of each. In this post we cover Reverse ATMs, Contactless cards, RFID, third party mobile wallets and white-label mobile wallets.

Further reading: Compare the different types of cashless payments

This post looks at the different types of cashless payment systems and the potential benefits and drawbacks of each method.

7. How to choose the right type of cashless payment system for your business

Once you’ve decided to take your business cashless and you have a good understanding of the different options available to you, then it’s time to decide which cashless payment system is going to work best for you and your organisation. Contactless cards, RFID, mobile payments, event Reverse ATMs - they’re all a means of removing cash from your venue. But how do they stack up against each other and against your business objectives?

After all, if all you simply want to do is remove the use of cash transactions at your event or venue, you could simply implement Reverse ATMs. This is a solution a number of US sports stadiums have implemented in recent years.

At the other end of the scale are organisations that have implemented white-label mobile payments, integrated with their own mobile app. These are truly ‘cashless’ payment systems in that they not only remove cash from a venue, they deliver a payment data ecosystem for businesses. These organisations own all of their customer transaction data. This data is then harnessed to deliver unparalleled customer insights, personalisation and targeted loyalty programs.

Suggested framework

The landscape for digital payments is becoming more complex as new technologies emerge and disruptors join the payment industry. As a result, we’ve sought to provide you with a framework to help you along the way.

Choosing the right cashless payment solution doesn’t have to be difficult - but it does start with articulating your business objectives.

Being clear on what you’re trying to achieve with a cashless payment solution will set you on the right path.

Be clear on your business objectives

If you’re looking for an offline cashless system that works without wifi for example, then RFID could be your best option, whereas if you’re looking to drive customer loyalty, Mobile Pay might be the preferred route. If you’re simply looking to remove cash from your venue, bank cards, mobile payments, RFID or a white-label mobile pay solution could work for you.

For a quick overview, why not try our decision tree.

We believe that business objectives should determine the right cashless payment solution for your event or venue. This post provides a series of example business objectives and the choice of corresponding cashless payment solution.

.jpg?width=1500&name=Cashless-Payments-Decision-Tree%20(2).jpg)

Further reading: How to choose the right cashless payment system

8. Download the cashless payments guide

If you’d like to share the information you have read so far, then make sure to download our cashless payments guide. This whitepaper takes a look at global statistics on cash usage and mobile payments, has easy to use comparison tables and an overview of the strategic business considerations involved when choosing the best route.

Further reading: Cashless payments guide

If you’d like to read an excerpt of the guide beforehand, then take a look at this blog post.

9. The leading trends in the cashless payments industry

Whilst cashless payments have been around for some time now, the last few years have seen dramatic increases in adoption rates as cash usage has declined.

The global pandemic forced customers to try new technologies such as mobile wallets or contactless cards to avoid touching surfaces and reduce the spread of the virus. And whilst Covid was instrumental in the adoption of these technologies, convenience and ease of use has cemented these behaviours into our everyday lives.

In the short term, these are the key trends that we think will dominate the payments industry in 2022:

- The continued decline in cash usage

- The growth in mobile wallets

- Data collection and ownership as a top priority for businesses

Further reading: Three leading cashless payment trends to watch in 2022

Summary

If you’re serious about increasing your revenue, really understanding all of your customers through the power of data and want to reduce your operating costs, we’d recommend you read this guide.

Every event or venue is different and each has its own unique challenges. We haven’t published this guide to replace conversations - we are here to help! So, if you’d like to know more about cashless payment systems, or want to understand how other businesses in your industry are benefitting from this technology then please get in touch with us.

COMMENTS