Over the last couple of years we’ve seen dramatic changes in consumer habits, the acceleration of digital innovation and the arrival of the ‘new normal’. This global transformation has led to unprecedented change in payments, fintech and customer experience.

Covid-19 has propelled consumers towards digital adoption in all aspects of their lives. The future has been pulled forward by a number of years.

So far, digital adoption shows no sign of slowing down. But what does the future hold? Here are our cashless payment trend predictions for the year ahead.

The continued move to cashless

As cash usage continues to decline, we can no longer say ‘cash is king’. In fact, we could say goodbye to cash completely. And much sooner than you think. It’s predicted Sweden could become the first cashless society as soon as 2023, with the UK expected to be cashless by 2026.

In Germany, where consumers typically favour cash, card transactions overtook cash for the first time.

In the USA tap and pay transactions jumped by more than 100% between 2019-2020 and cashless payment volumes are expected to further increase by 43% between now and 2025.

In 2020 a Mastercard study found 74% of global consumers said they would keep using contactless beyond the pandemic. So we know this dramatic shift in consumer behaviour is here to stay.

The growth in mobile wallets

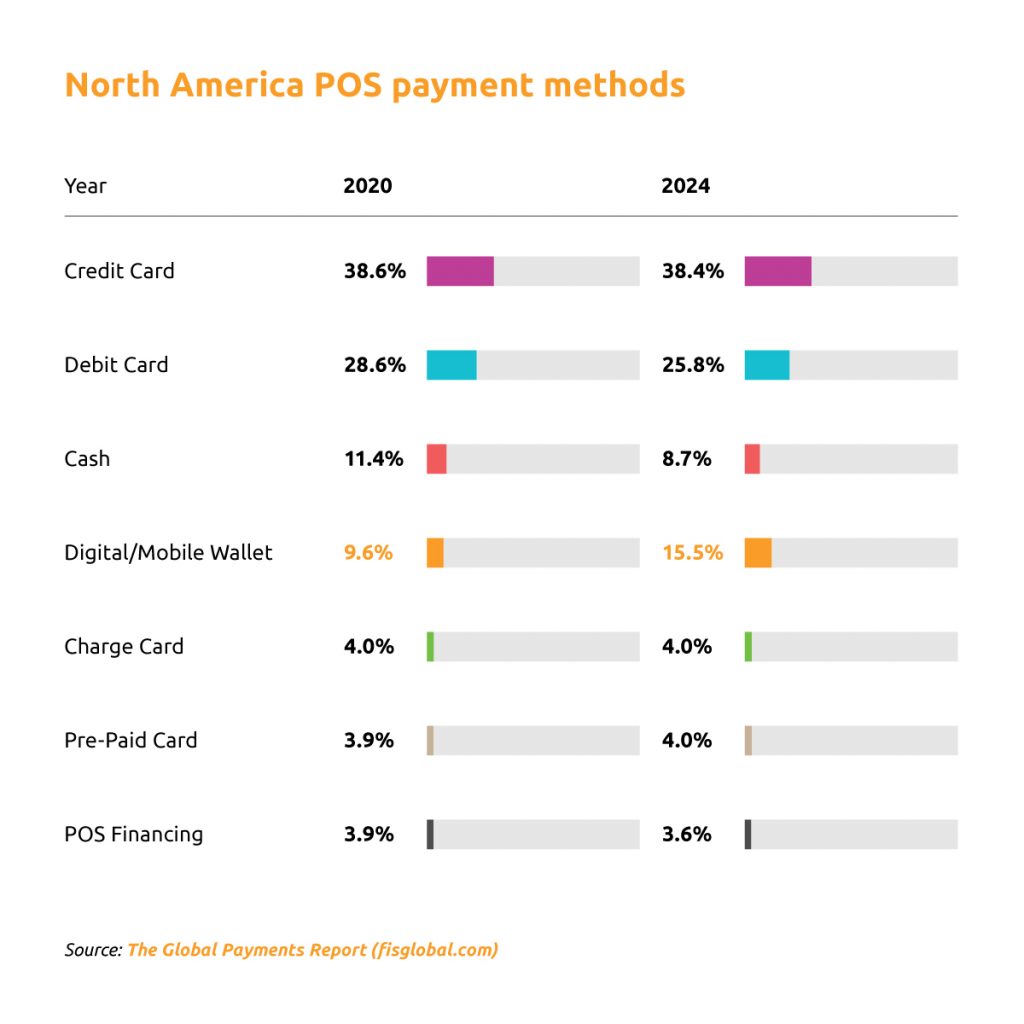

Over the last few years, when we look at changes in payment methods, we can see digital wallets spend has increased, as many cash users make the transition to mobile payments.

Contactless debit and credit card payments will continue to dominate for the next few years. However soon, we expect digital wallets to compete for dominance with contactless cards as the most popular payment method at point of sale.

Why? Firstly this is due to the proliferation of QR codes, super apps and mobile banking. These trends will have a significant impact on the user experience and the ease of use across every payment point. Secondly, mobile payments are already the preferred payment method for Generation Z, people who were born between 1997-2012. Together, Gen Z and Millennials are highly tech-savvy, mobile-natives who have inherent increased interest and demand for digital payments products.

Data and the customer experience

In just a few short years, we’ve seen cashless payments become the norm for pro sports teams, stadiums and festivals. But whilst the end-goal may have been to simply remove cash from a venue, organisations are now starting to understand how cashless payments can be used for so much more.

Cashless payments deliver sharper insights into consumer behaviour and platforms which offer a ‘single source of truth’. This data provides a clear understanding of how the customer operates – what they want and when.

The first-party data associated with cashless payments can reward consumers when leveraged in a loyalty platform. This data can be leveraged to create targeted rewards and incentives based on key consumer behaviours – to build loyalty, grow engagement and boost overall revenue.

In the coming years, we will see that cashless organisations will harness their data to reward customers, give personalised experiences and offer far more tailored products and services.

These three trends all have a common thread – a demand for flexibility and a frictionless experience. Consumers want convenient payment methods; ones that make their lives easier. Furthermore, they expect great value and a personalised experience.

If you’d like to know more about cashless payments and how they can help you to drive revenue for your business, then get in touch.

Further reading:

COMMENTS