QR codes were once seen as an outdated marketing trend. Ten years later, with the arrival of Covid-19 and the near market saturation of the smartphone, this has all changed.

QR codes are now an integral and essential part of everyday life around the world. With the pandemic accelerating the global adoption of touchless technologies, digitisation and electronic payments, the use of QR codes is becoming the easiest and most accessible route to communicate, engage and transact.

A recent study by Juniper Research forecasts the number of global users of QR code payments will exceed 2.2 billion in 2025, up from 1.5 billion in 2020. From restaurants and hospitality, to government and safety information, QR codes have become ubiquitous, empowering anyone with a smartphone to easily access information and content. QR codes have also created new, compelling media channels for brands – distributing unique content and targeted offers to consumers and fans.

QR codes in the U.S.

The Asia Pacific region, particularly China, has enthusiastically embraced QR codes for years. Mobile payments, which can’t happen without QR codes, appeared in China in the early 2010s and exploded in popularity 2014-2016. Today, the payments landscape in China is completely transformed.

Conversely, the U.S and Europe traditionally favoured debit cards and credit cards -until now. The growth in mobile payments over the last year has been phenomenal. In the U.S. it’s forecasted that over 100 million Americans will use mobile payments this year.

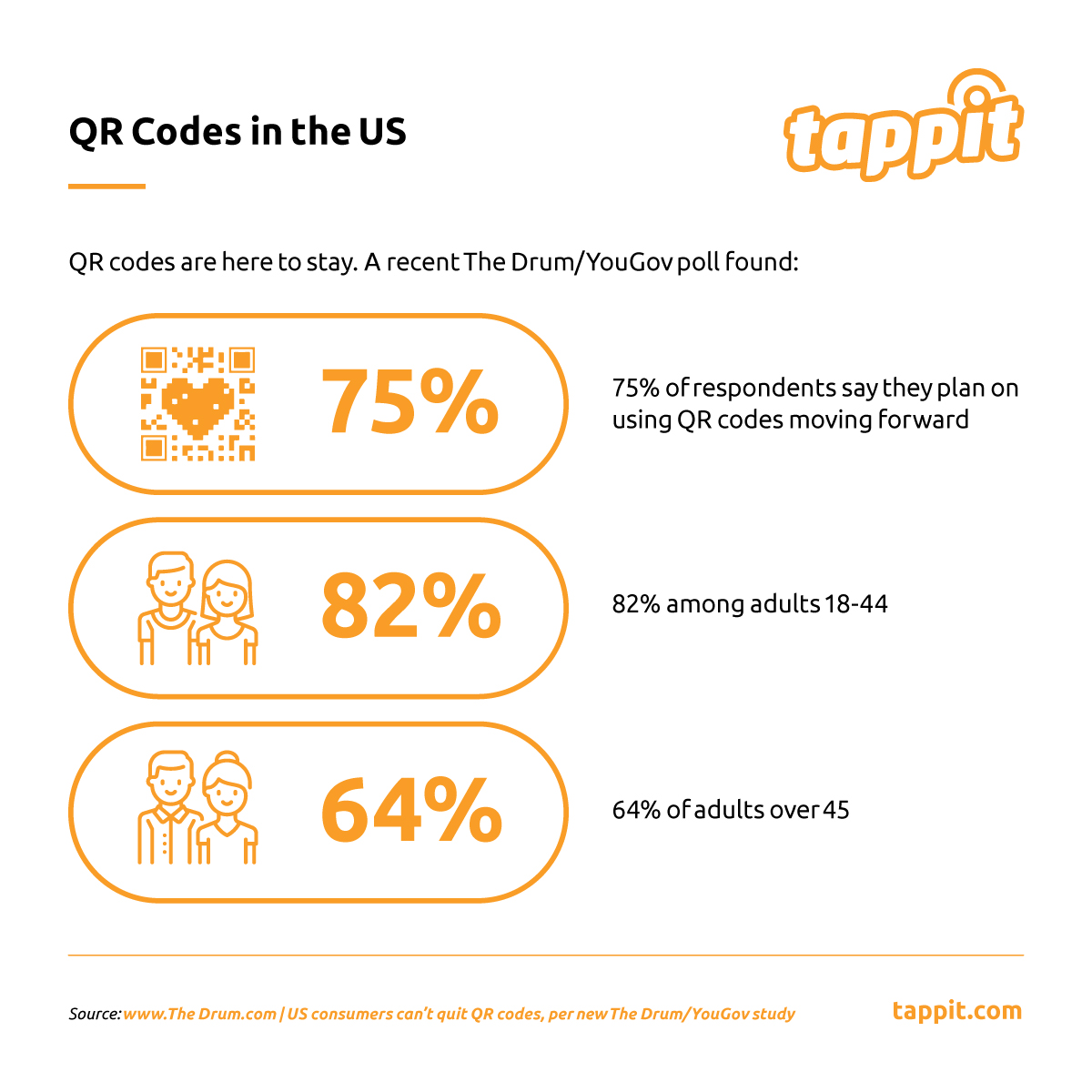

As the US returns to normal, it appears that QR codes are here for the long haul and the technology will ‘stick’ this time. According to a new study from The Drum/YouGov, 75% of US respondents say they plan on using QR codes in the future. This number rose to 82% among adults 18-44, but dipped to 64% of adults over 45. Just 9% of the survey respondents didn’t know what a QR code was.

“Since 1994, QR codes have made many efforts to become relevant without success,”

says Tamara Alesi, YouGov’s sector head of media.

“The pandemic changed that. For the first time, QR codes have a real purpose. In a world where ‘touchless’ became a mandate to protect consumer health, the value proposition of the QR code finally became clear to the world at large. Now consumers are using QR codes in everyday life, to view menus, pay restaurant bills, get more information on home and car sales, and more. I’d expect that consumer adoption to stick. More so, I think the trees and environment may be thanking QR codes too.”

The stage is set for making the fan experience even better

Consumers have become more accustomed to using QR codes and they are beginning to appreciate what brands have to offer. In the last three months, 45% of US consumers have used a QR code related to a marketing, advertising or promotional offer. This demonstrates the huge potential for organisations to harness the power of QR codes to engage, incentivise and most importantly, improve the customer experience.

The key problem with QR codes prior to the pandemic was that customers didn’t know how to engage with them. That is no longer an issue as the understanding of ‘point the camera and click the notification’ knowledge becomes widespread.

QR codes and mobile payments

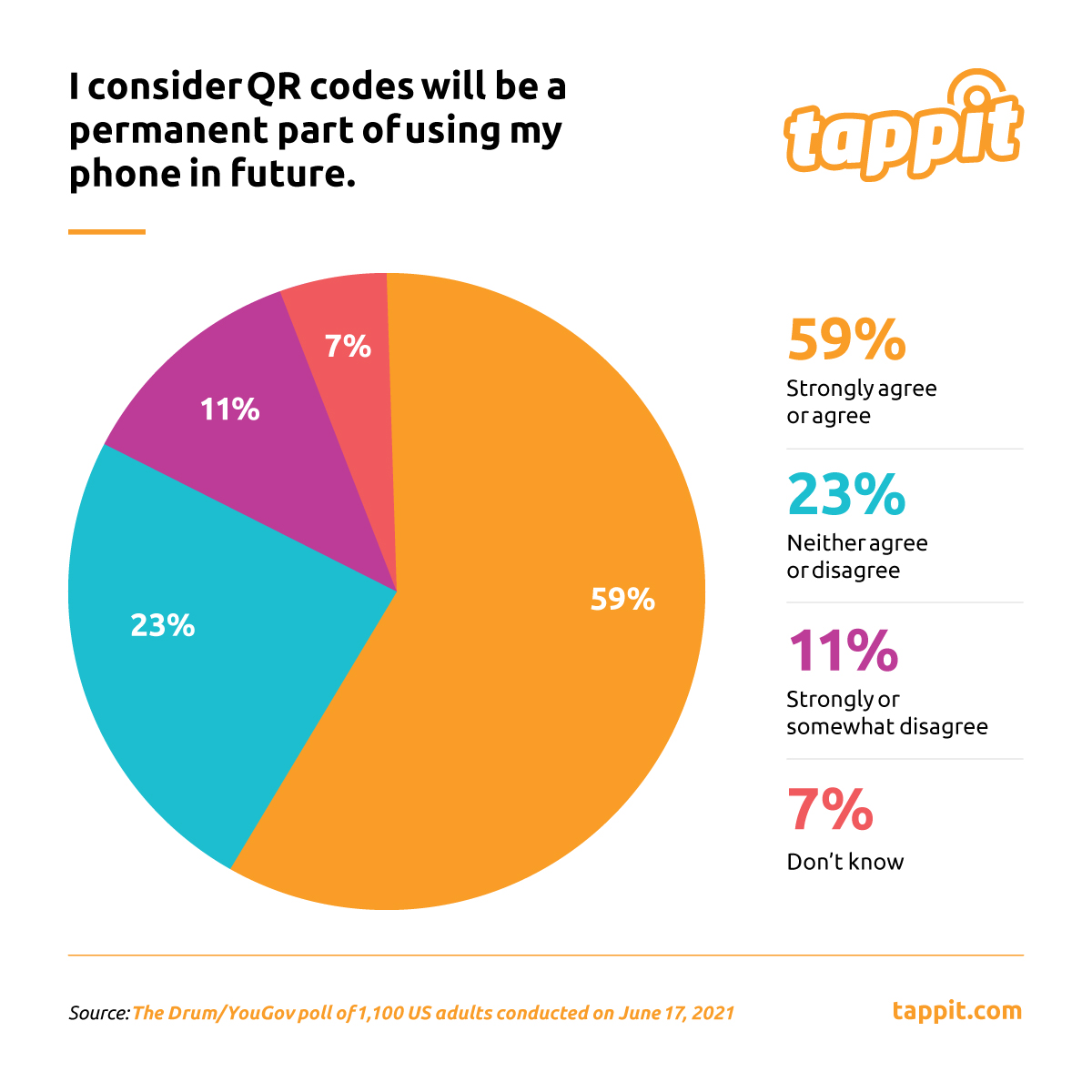

Consumers say QR codes are here to stay, with nearly six in 10 (59%) of all respondents saying they will be a permanent part of using their phone in the future.

Recently, the Executive Client Services Director of R/GA Singapore, Felix Rompis stated :

“It takes a global pandemic for people to (more or less) adopt new human and technological behaviors at speed. When this is all over, few will stick. People will want to simply stroll into restaurants and peruse paper menus again – but they’ll also want to be able to pay contactless. Therein lies the only, long-term consumer future for QR codes amidst its resurgence: mobile payments.”

At Tappit, we couldn’t agree more. In the previous NFL season and with our work at the San Diego Padres, San Antonio Spurs and Cincinati Reds, we have seen rapid and increasing adoption of our mobile wallets – which use QR codes to enable fans to transact in a safe, frictionless way.

We have seen fans of all ages adopt the digital wallet and their feedback has been incredibly positive. Moreover, operational staff and retail teams have also found the QR codes a remarkably effective and simple way to transact, with none of the hassle and risks of working with cash or waiting for a mobile connection.

Taking QR codes to the next level

The next opportunity for organisations who adopt the right QR mobile pay system, is around customer engagement and data. Through paying with QR codes, and using a closed loop system, the data and insights that organisations receive about their consumers becomes invaluable.

For the very first time, organisations get to keep the data and fully understand their customers: what they bought, when and where and connect this to other data points. Unlike standard card or contactless payments (where all the data goes to the banks), organisations get to keep the data and understand. The next huge opportunity is to utilise the data to enhance the customer experience and also increase revenues and improve operational efficiencies.

At Tappit, we’re passionate about making the fan experience even better and increasing profits for the partners we work with. All of this starts with the QR code and the powerful data it can unlock, alongside the simplicity and ease of use.

COMMENTS